At Homeric, we believe in empowering our clients with knowledge to make the best decisions for their financial future. In this guide, we’ll walk you through what to look for when comparing mortgage rates. Now, you’ve probably bumped into what we call a ‘rate table’ on most lenders’ websites. Picture this: it’s like a Polaroid snapshot of the lender’s mortgage products, rates, and those estimated monthly payments for a home – your future home. Yes, they can seem like a Rubik’s cube at first glance, but don’t fret! They’re actually your golden ticket to finding the right mortgage. Now, let’s peel back the curtain and demystify these enigmatic rate tables.

Tables of change – no two are alike!

Here’s a fun fact: rate tables are like fingerprints or zebra stripes – no two are the same. Different lenders offer different loans, terms, and fees. So, put on your Sherlock Holmes hat and scan multiple rate tables before making your decision. What’s more, these tables have mood swings. The same rate table can show entirely different rates from one day to another, thanks to a medley of factors like inflation, economic growth, and the housing market’s health.

Mortgage rates can also be as diverse as a bag of Skittles. For instance, a 30-year fixed-rate mortgage (the long-game player) will often have a higher interest rate than its 15-year sibling. And the prodigal son, the mortgage to refinance a home, usually has a lower rate because the lender knows this borrower has a history of making timely payments.

So, when you’re doing your homework, remember to make ‘apples to apples’ comparisons. Don’t mix Granny Smiths with Golden Delicious.

What do all the numbers mean?

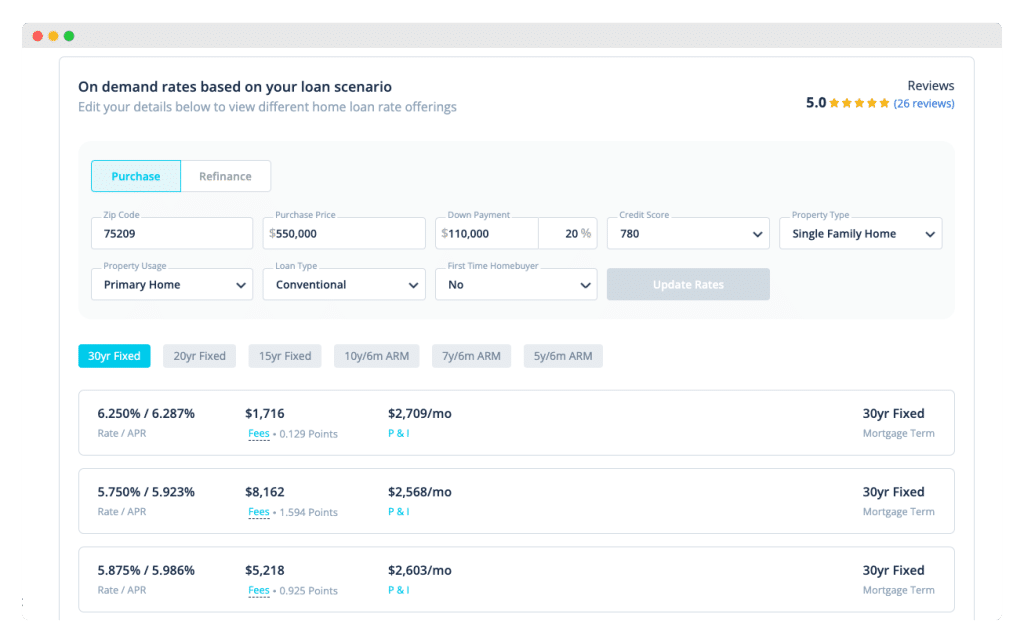

Rate tables generally display the best interest rate available for each specified loan. However, the rates you’ll qualify for depend on various factors, including your credit score, down payment, and the type of property you’re purchasing. Every lender has a unique way of showcasing rates, like an artist with a distinctive style. However, they usually display the same core information. Here’s how to decode a rate table:

Rate type

First stop, the types of mortgages that the lender has on their menu. You’ll see the loan term and whether the mortgage has a fixed or adjustable interest rate.

Interest rate

This is the big headline number. Remember, the rates you’ll actually qualify for depend on several variables, like your credit score, down payment, and the type of property you’re eyeing.

APR

While many borrowers focus on interest rates, the annual percentage rate (APR) provides a clearer picture of what you’ll pay for your mortgage. This is the real deal. The annual percentage rate (APR) gives you the full picture wrapping the interest rate and some costs into one neat bundle.

Points and credits

These are like the yin and yang of your mortgage. Points also know as discount points, decrease your interest rate for a one-time fee. It is know as “buying down” a rate and results in a lower rate for a cost. 1 point is 1% of the loan amount and typically reduces the interest rate by .25%. Credits are the opposite and your lender will provide a credit to lower closing costs in exchange for a higher interest rate. Understanding the balance between points and credits can help you choose the most cost-effective mortgage.

Monthly payment

Most lenders will also share the estimated monthly payment for each loan based on the interest rate. it is important to note that these payments are usually only for the principal and interest portions of your payment and do not account for monthly escrow fees such as homeowners insurance, property taxes and private mortgage insurance if required.

Disclaimer: Graphics and rate tables are for illustrative purposes only. Check our rate tables for current rates.

Be aware: You may not qualify for an advertised rate

Here’s a heads up: mortgage rates can be like an elusive unicorn. The advertised rates you see can depend on several factors, and they might be out of reach.

- Credit score: If your credit score is more of a house cat than a lion, you might not qualify for the best-advertised rates.

- Down payment: Even with a solid credit score, low-interest rates might slip through your fingers if you put down less than 20%.

- Other financial considerations: Things like your debt-to-income ratio or any black marks on your credit score could be deal-breakers or result in big rate differences when using rate tables.

Interest Rates

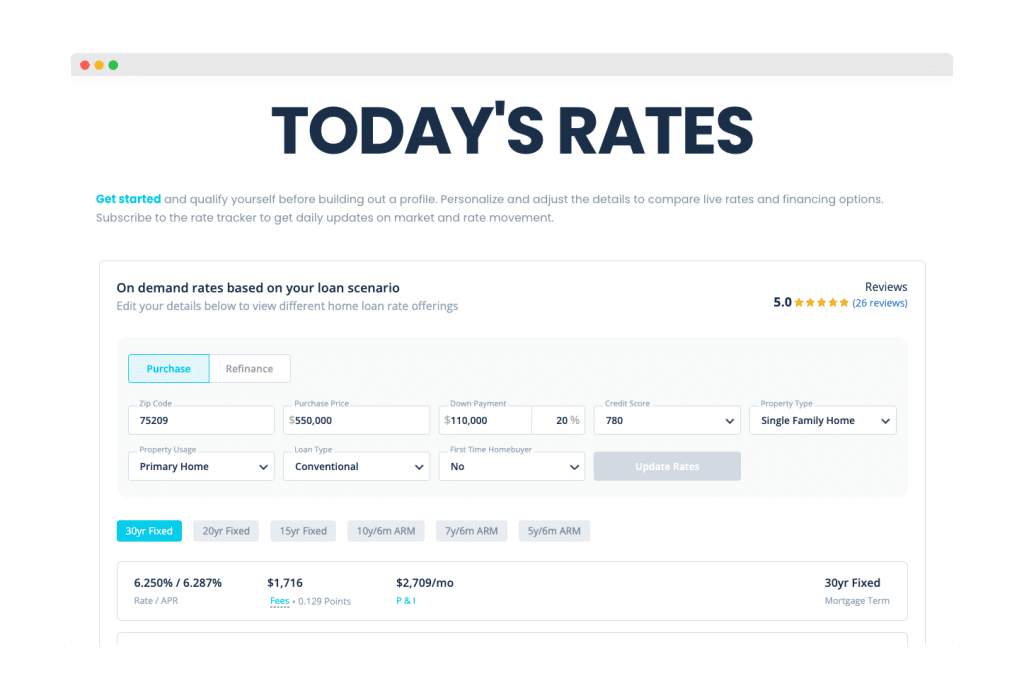

Your rate dashboard & loan options

Choose a lender with transparency – not invisibility cloaks

Not all mortgage lenders are cut from the same cloth. Some might not lay all their cards on the table. They may highlight the interest rate but not the APR, or they might show you an amazing low rate and the fine print include the 1-2 points you need to bag that listed rate.

Some lenders might be like the Great Oz, pulling the levers behind the curtain, luring you in with tantalizing rates that might be out of reach for most borrowers or come with a hefty price tag.

With Homeric, we’re all about transparency. We give you the full picture, right in the rate table. Plus, you can tweak the rate table to fit your circumstances, entering your location, home value, down payment, and estimated credit score, along with the property type and if you’re a first-time homebuyer or VA. When ready, build out your profile and get the clear financing breakdown for what you can afford, rates and loan options you qualify for and pre-approval letters to go with offers.

Ready to get started on your financing options? Check out our rates and get a customized estimate based on your unique situation.

Disclaimer: This content is for informational and educational purposes only. Graphics and rate tables are for illustrative purposes only. Check our rate table for current rates.